Several of Downtown Denver’s largest towers sit half empty as the clock ticks on unsustainable debts that must be refinanced, repaid or renounced.

Unable to find enough tenants to support debt payments, about three in 10 commercial mortgages tied to office buildings in metro Denver are delinquent, the third-worst showing in the country out of 50 metros, according to a report from Trepp last summer.

READ THE FULL PROJECT: At a crossroads: Downtown Denver is waiting for its rebound

Lenders, tired of waiting for a rebound, have taken over management or ownership of several buildings, including the iconic Wells Fargo Center, which the Denver Nuggets feature in their skyline logo, and the Denver Energy Center.

“I think we have a long road,” said Amy Aldridge, partner at Tributary Real Estate. “Honestly, we have a lot of 1980s high-rise towers that are mostly vacant. People want to come back to the office, but they don’t want to come back to the 1980s office.”

Discounts of 80% to 90% or more below the prior purchase price, once unimaginable, have emerged in the past year on oil boom-era buildings. Colorado Plaza Tower I and Tower II, at 633 and 621 17th St., sold in April for a jaw-dropping 98% discount. Valued for $200 million as recently as 2019, the towers could only fetch $3.2 million, sending an SOS flare soaring above the downtown skyline.

Newer office buildings in Lower Downtown, Union Station and the Central Platte Valley, while not at capacity, remain highly rentable. For office towers built after 2000, the vacancy rate averages a manageable 16.8%, about half the rate seen for the office towers built during the oil and gas boom in the late ’70s and early ’80s.

While some longtime downtown tenants are leaving for trendier markets like Antero Resources to Cherry Creek or Xcel Energy to the River North Art District, those committed to downtown still have appealing options, but not in the area with the heaviest concentration of office towers.

A flight to quality is underway, and it comes at the expense of older towers in Upper Downtown and Skyline Park. Downtown’s office market is essentially cannibalizing itself to survive.

Downtown Denver’s most distressed office towers are in a zone that stretches from Lawrence Street to Lincoln Street and from 14th Street to 20th Street, which mostly overlaps with an area known as Upper Downtown, home to the highest concentration of commercial real estate in the Rocky Mountain region.

It was the part of the metro area hardest hit in the pandemic and it has been the slowest to recover, according to Denver’s Downtown Development Authority Plan of Development, which Denver City Council amended and adopted on Dec. 9.

Thirty properties in Upper Downtown have been identified as distressed or deteriorating, defined as marketing over 40% of their rentable building area for lease. That list includes the Wells Fargo Center, 1999 Broadway, and the Lincoln Crossing tower.

A Denver Post analysis of the 105 largest downtown office buildings, with 100,000 or more square feet, found that more than a third face extreme financial distress that extended beyond a high vacancy rate.

That includes a loan default; a lender appointing a third party to manage a building, known as a receivership; a foreclosure where the lender took possession; a borrower voluntarily surrendering ownership to avoid a foreclosure; a distressed sale with a large discount, and buildings being deliberately emptied to prepare for a conversion to other uses.

BusinessDen, a partner of The Denver Post, maintains a running list of Denver’s most distressed commercial buildings, as well as a list of downtown’s emptiest buildings and those slated for a residential conversion. Here are some of the better-known downtown towers that are in trouble.

- Republic Plaza at 370 17th St.: Brookfield Properties and MetLife Investment Management defaulted on a $134 million debt and reworked terms with bondholders in March 2023. Brookfield has had success in adding tenants, but the vacancy rate in Denver’s tallest tower remains elevated. That could complicate a refinancing when the loan comes due again next March.

- Wells Fargo Center at 1700 Lincoln St: Brookfield also failed to pay off a $327 million loan from Morgan Stanley that it used to purchase the iconic Cash Register Building when it came due in December 2022. Judy Duran of CBRE was appointed as a receiver to manage the property.

- Civic Center Plaza at 1560 Broadway: Rising Realty last November handed ownership of the tower back to Heitman Capital Management, which had provided it a $101 million loan in June 2019.

- Denver Energy Center at 1625 and 1675 Broadway: JPMorgan Chase foreclosed on the twin towers and reclaimed them in June 2022 for $88.2 million after Gemini Rosemount defaulted on a $114 million loan it took out in 2013.

- Trinity Place at 1801 Broadway: LoanCore Capital of Connecticut claimed ownership of the tower at a foreclosure auction in November after Chicago-based Expansive, a co-working space provider, defaulted on a $35.4 million loan it took out in April 2019.

Lenders, if hesitant to take over a commercial building, will sometimes ease terms or delay taking action, a practice known as “extend and pretend.” Some of Denver’s towers may be current on debt payments, but only because loan terms were modified quietly. With vacancy rates and interest rates elevated, lenders may not be as patient as they were coming out of the pandemic.

Distressed situations can eventually result in distressed sales that wipe out the equity that owners put in and saddle lenders with large write-offs. And they eat away at the value of the surrounding buildings.

The Hudson’s Bay Centre at 1600 Stout St. sold to Dikeou Realty in October 2024 for $8.95 million, marking a nearly 80% haircut from its 2014 sales price of $41.5 million. Lincoln Crossing, a two-tower office campus at 1775 Sherman and 1776 Lincoln, sold in early April for $10 million, a 90% price discount from the price paid in 2018.

But the winner so far in the limbo game of how low can you go is Los Angeles developer Asher Luzzatto, who purchased Colorado Plaza Tower I and Tower II for the equivalent of $3.30 a square foot in a market where the average advertised office rent is $41.87 a square foot.

Luzzatto pulled off the equivalent of purchasing a rental car for the cost of a one-month lease. But both the engine and transmission are shot. His big spend will come later, when he invests $150 million to $200 million to create 700 apartments in the two towers, he told BusinessDen.

The buildings are on a ground lease, meaning the underlying land wasn’t part of the sales price. They are also on the older side, one constructed in 1957 and the other in 1973. But the towers weren’t crumbling edifices in fringe locations. With a combined 1.14 million square feet, they would rank as downtown’s fourth-largest complex behind the Wells Fargo Center.

Lower building values reduce what Denver can collect in property taxes, while empty buildings reduce the employee and sales tax generated by tenants. New residents will contribute to a more vibrant downtown and boost sales tax collections, but probably not enough to compensate for the lost property values.

A successful apartment conversion will generate about a quarter of the property taxes that a healthy office building would have otherwise generated, because of Colorado’s lower residential assessment rate, said Denver County Assessor Keith Erffmeyer.

Erffmeyer estimates downtown commercial real estate values fell by about a quarter in the last two-year assessment cycle, which ended on June 30. The most extreme discounts started showing up after that.

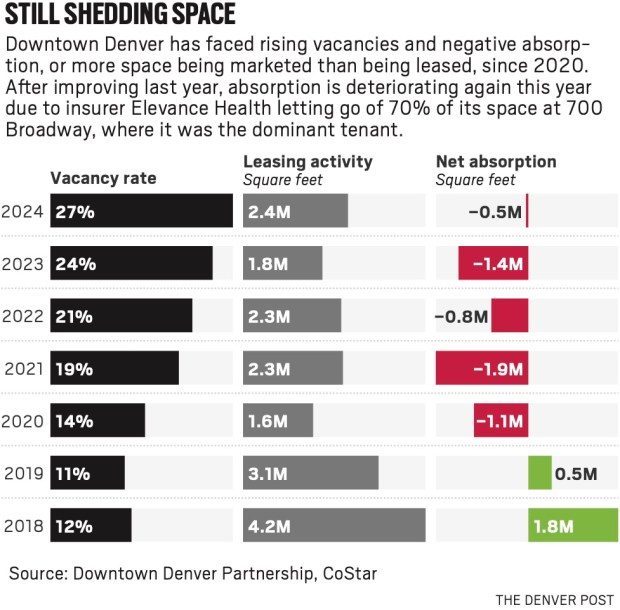

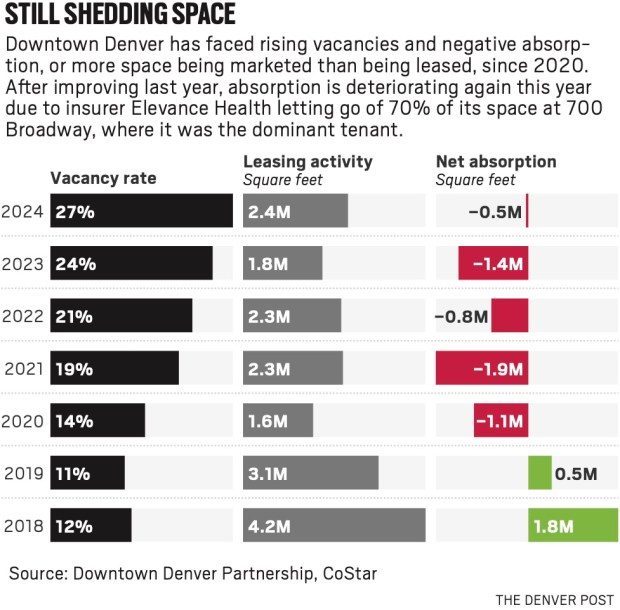

Even seemingly full buildings can get into trouble quickly. The Anthem Building at 700 Broadway on the border of Capitol Hill and downtown’s Golden Triangle had one of the lowest vacancy rates of any central Denver office tower at 4.7%. That reflected the dominant presence of Elevance Health, formerly Anthem, and before that Blue Cross and Blue Shield

Elevance late last year said it would give up 258,500 square feet of its leased space at the end of 2024, which single-handedly took the building’s once-solid vacancy rate to 60%. The lender put the building into a special servicing arrangement.

The move contributed to central Denver seeing almost as much office space come back on the market in the first quarter as in all of 2024, and it dashed hopes that the office leasing market was finally stabilizing.

An added source of stress for downtown landlords this year is coming from the federal government, normally considered one of the most stable tenants available. The Department of Government Efficiency, which the Trump administration has tasked with cutting down costs, is looking to terminate as many federal leases as it can and to sell off federal buildings.

1999 Broadway, which is already half vacant, could approach a 70% vacancy rate if the Internal Revenue Service drops the 125,000 square feet it holds there. Three blocks away, 1670 Broadway shows a healthy 15.4% vacancy rate on paper. But after a default last October, the lenders appointed an outside party to manage the building.

Too much debt is the core issue. Hana Financial Group, a Korean firm, paid $238 million for the building in August 2018 and couldn’t refinance the loan when it came due in the fall of 2023. Its lenders found someone else to manage the building, which has seen its outlook deteriorate even more.

DOGE in February said it wanted to terminate a lease for 86,809 square feet or 18% of the remaining square footage that Housing and Urban Development held in that building. Last August, the building’s largest tenant, TIAA, said it would relocate its Denver operations to a new campus in Frisco, Texas.

At the end of April, TIAA informed the state it would be terminating its lease three years ahead of schedule, in July 2026, and would let go of 84 Denver workers and move into a smaller space until its Frisco campus was completed. Once one of downtown’s largest employers, TIAA will leave behind a much smaller group in Denver to support teams working with clients.

Get more real estate and business news by signing up for our weekly newsletter, On the Block.

Recommendations

Recommendations More for your eardrums

More for your eardrums Startup to watch

Startup to watch More for your eyeballs

More for your eyeballs Hottest GTM jobs of the week

Hottest GTM jobs of the week GTM industry events

GTM industry events